AI in Insurance Technology

The integration of AI in insurance technology presents a significant shift in operational methodologies. By utilizing AI chatbots, companies enhance customer service through personalized support. Meanwhile, advanced data analytics refine risk assessment and underwriting processes. Additionally, machine learning optimizes claims management and fraud detection. This ongoing transformation raises critical questions about its long-term implications for industry standards and customer interactions. What challenges and opportunities lie ahead in this evolving landscape?

Transforming Customer Service With AI Chatbots

How effectively can AI chatbots enhance customer service in the insurance industry?

By facilitating personalized interactions and providing automated responses, these chatbots streamline communication and improve efficiency. They can address customer inquiries round-the-clock, effectively reducing wait times and increasing satisfaction.

Furthermore, their ability to analyze customer data allows for tailored experiences, fostering a sense of autonomy and freedom in the decision-making process.

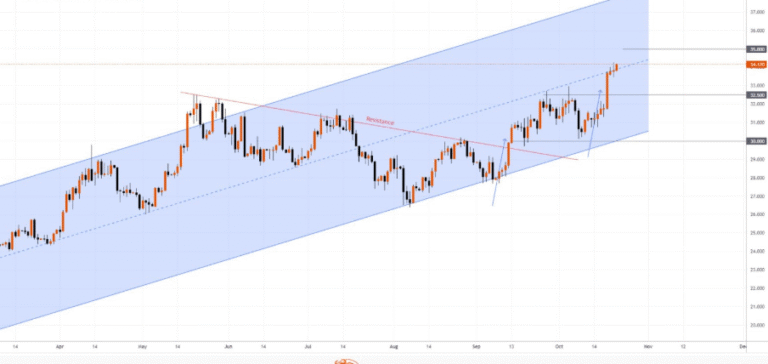

Enhancing Risk Assessment Through Data Analytics

As organizations in the insurance sector increasingly integrate advanced data analytics, the enhancement of risk assessment emerges as a pivotal benefit.

Predictive modeling allows insurers to forecast potential risks with greater accuracy, while data visualization tools facilitate the interpretation of complex datasets.

This synergy enables insurance professionals to make informed decisions, ultimately leading to more precise underwriting and improved financial outcomes for the organization.

Streamlining Claims Management With Machine Learning

The integration of machine learning in the insurance sector is poised to significantly streamline claims management processes.

By employing predictive modeling, insurers can enhance the accuracy of automated claims assessments, reducing processing times and improving customer satisfaction.

This technology enables the identification of fraudulent claims more effectively, allowing for a more efficient allocation of resources and ultimately fostering a more responsive claims environment.

See also: AI in Fraud Detection Technology

The Future of AI in the Insurance Industry

While the current applications of artificial intelligence in the insurance industry demonstrate significant advancements, the future promises even more transformative changes driven by evolving technologies.

Enhanced predictive modeling techniques will enable insurers to anticipate customer needs more accurately, while sophisticated fraud detection algorithms will mitigate risks and protect resources.

Together, these innovations will empower insurance companies to operate with unprecedented efficiency and agility.

Conclusion

As insurance companies embrace AI, one can only wonder if the true beneficiaries will be the algorithms or the clients. With chatbots tirelessly answering questions at all hours and machine learning promising to detect fraud with precision, the industry seems poised to transform. However, amidst these technological marvels, the human touch may become as obsolete as a fax machine in a digital age. In this brave new world, will customers find solace in efficiency, or nostalgia in the warmth of human interaction?