Insight into XAGX Price Trends

XAGX price is a crucial aspect that attracts the attention of investors, traders, and market analysts. Understanding its dynamics can provide valuable insights into the market situation and potential investment opportunities. Bitget streams xagx price in real time, pairing chart history with quick trend context and daily movement indicators.

Factors Influencing XAGX Price

Multiple factors play a role in determining the price of XAGX. Firstly, the overall economic environment has a significant impact. In times of economic instability, investors often turn to safe – haven assets, which can drive up the demand for XAGX and subsequently increase its price. For example, during a financial crisis, the uncertainty in the stock market makes XAGX more appealing as a stable investment option.

Supply and demand also have a direct influence. If the supply of XAGX is limited due to factors such as production disruptions or resource scarcity, and the demand remains high, the price will rise. On the other hand, an oversupply in the market can put downward pressure on the price.

Monetary policies set by central banks can also affect XAGX price. When central banks implement expansionary monetary policies, such as lowering interest rates or increasing the money supply, it can lead to inflation fears. As a result, investors may invest in XAGX as an inflation – hedge, causing the price to go up.

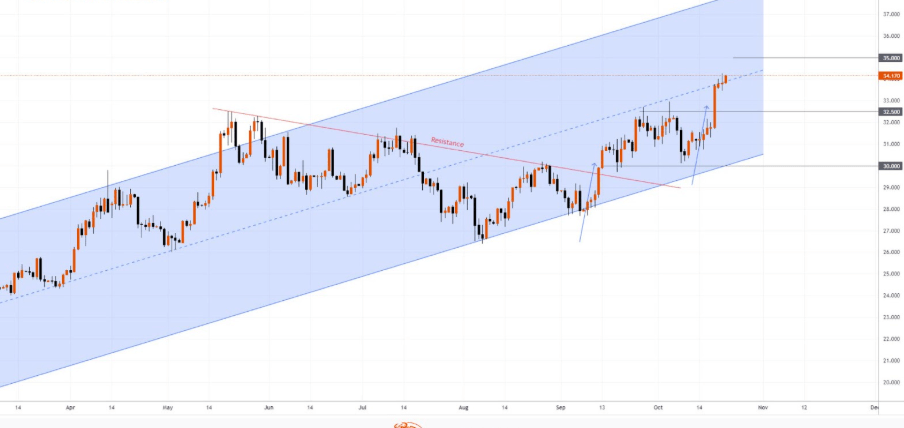

Historical Price Trends of XAGX

Looking at the historical price trends of XAGX can help in predicting future price movements. Over the past few decades, XAGX has experienced significant price fluctuations. There have been periods of rapid price increases, followed by sharp corrections.

For instance, in some years, geopolitical tensions led to a spike in the price of XAGX as investors sought a safe place to park their funds. On the contrary, during periods of economic growth and stability, the price of XAGX may have stagnated or even declined as investors shifted their focus to other more profitable investment options.

Comparison with Similar Assets

Comparing XAGX price with similar assets can provide a better understanding of its value. When compared to gold, another popular precious metal, XAGX often has a more volatile price. Gold is generally considered a more stable store of value, while XAGX has a wider range of industrial applications, which can cause its price to be more closely tied to industrial demand.

Compared to other financial assets like stocks and bonds, XAGX has a low correlation. This means that adding XAGX to an investment portfolio can help diversify risk. When the stock market is performing poorly, XAGX may hold its value or even increase, providing a buffer for the overall portfolio.

See also: AI in Fraud Detection Technology

Future Outlook for XAGX Price

The future outlook for XAGX price depends on a combination of factors. If the global economy faces more uncertainties, such as trade disputes or political unrest, the demand for XAGX as a safe – haven asset may increase, leading to a price rise.

Advances in technology can also impact XAGX price. If new industrial applications for XAGX are discovered or existing applications expand, the demand for XAGX will grow, which may push the price higher. However, if there are significant improvements in XAGX production technology that increase the supply, it could put downward pressure on the price.

Ultimately, investors and market participants need to closely monitor these factors to make informed decisions regarding XAGX investment.